¡HI! If you want to propose us a project, send a mail to info@albatian.com

ALL INFORMATION ABOUT

BPM, PROCESS, R & D, TECHNOLOGY

Why BPM is Vital for Insurance Companies

By: Pedro Robledo, BPM process management expert

Companies in the insurance sector seek to increase the effectiveness, efficiency and productivity of management. They face significant challenges in providing faster responses, reducing operating costs, responding quickly to regulatory changes, and operating satisfying consumers in an attempt to retain customers.

In their management they operate with increasing volumes of data, excessive manual processes, inefficient legacy platforms and processes, high error rates of manual tasks, non-integrated applications, which contribute to increased costs. If we also think about the lack of visibility of key flows, we will add many lost of sales opportunities.

Conducting a study of 53 success stories published by BPM (Business Process Management) manufacturers from five continents (16 from North America, 4 from South America, 27 from Europe, 4 from Asia and 2 from Oceania), it can be confirmed that the application of the BPM management discipline and the maturity implementing BPMS, provides important benefits in insurance companies.

The application of BPM makes it easier for insurance companies to face 10 main challenges such as:

- Claims that are processed through non-integrated applications, with information in different systems and that do not allow a global vision.

- Avoid claim fraud.

- Avoid transferring large volumes of paper files with customer and policy documentation in different formats and locations.

- Customer requests sent through various channels that are processed manually.

- Difficulty in monitoring the files, knowing what has been done and what is pending. Interest in having greater fluidity and consistency in the exchange and dissemination of information, to enrich customer knowledge, facilitate the work of employees, improve customer service, and comply with SLAs.

- Reduce error rates, improving quality.

- Lack of critical control and audit functions.

- Slow and costly exception handling.

- Reduce learning time with new hires.

- Comply with regulatory changes and risk management.

In the study, a significant number of evidences of successfully automated processes in a BPMS have been detected:

- Insurance Policy Claims Process.

- Process of Hiring an Insurance Policy.

- Underwriting Process for Corporate Risks.

- Audit process for agility of response to constantly changing regulations.

- Peer Review Process.

- Customer Service Process (Requests and Complaints)

- Accident Management Process.

- Legal and Property Protection Processes.

- Inventory Management Process.

- Claims Settlement Process.

- Reservation and Quotation Process.

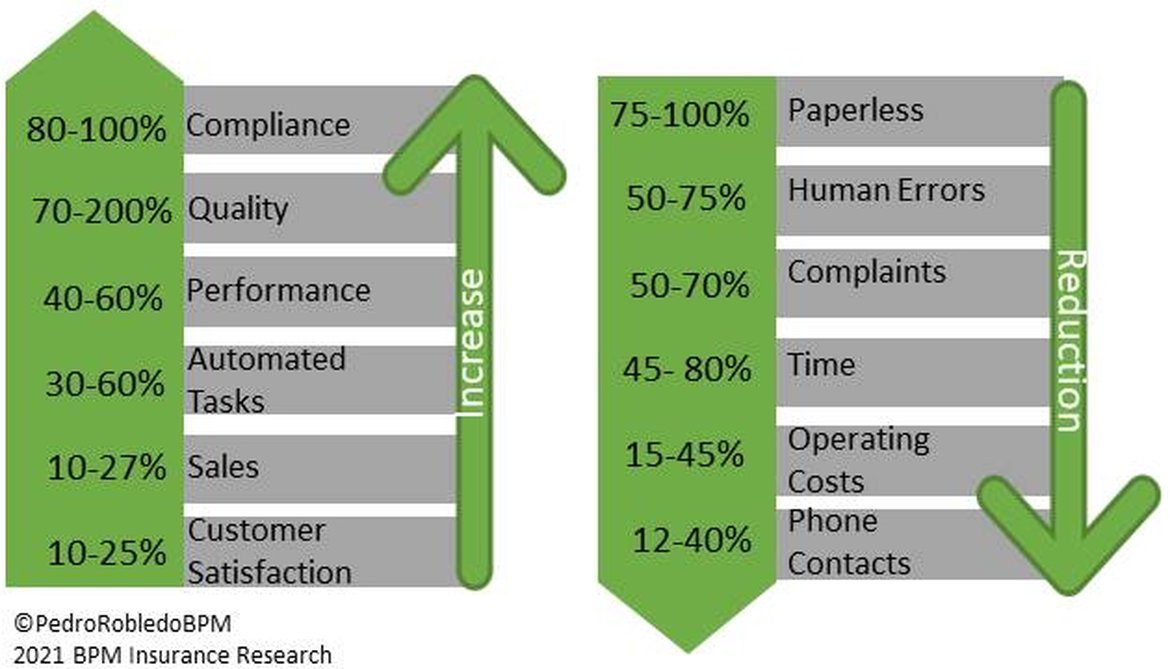

The cases reviewed show important advantages that BPM provides to insurance companies, as shown in the following image:

In the study companies, the following 10 benefits stand out for which any insurance organization should implement BPM:

- Quick response and reduction in processing time, with cases where the time for processing claims or processing a policy is reduced by 50%. Or deliveries of complex estimates in 14 minutes.

- The employee is empowered by planning priority tasks. Users follow the process without bypassing the workflow, providing them with priority and urgent task lists. Getting 15% increases in the number of transactions processed by one person.

- It is easier to automate manual processes and integration with other applications, to reduce manual work for employees. There is evidence of automation of more than 60% of the previously manual steps. they were automated.

- Improvement in the follow-up of the file thanks to the grouping of all the information: emails, payment details, information on participants. Each file can be managed by N employees, which allows more agility and speed in the response to the client. Visibility of bottlenecks in claims management and quick reaction to the situation.

- Reduction of learning time with new hires. Automated process orchestration makes it easy for new hires to be productive right out of the box.

- Improve Quality and reduce human errors. Evidence of quality improvements is detected in 70 to 200%. And more than 75% of human errors are avoided.

- Regulatory compliance, risk control and an automated record of audits is available. The traceability of the finished and running processes is available in real time, which allows greater internal control, and visibility supported by evidence. It improves regulatory control, and the rapid application of new laws.

- Cost savings, which is reflected in the reduction of times, optimization of resources, rapid implementation of new requirements, reduction of errors, and increased sales due to customer loyalty and the preparation of more accurate budgets.

- Automatic validation of documentation, balances due on the date of occurrence and declaration of total loss if the damage exceeds a porcentaje of the insured value. It facilitates the effective and efficient validation of the information and manage in an agile way.

- Improved customer service, providing internal and external customer satisfaction. A 20% improvement in the Net Promoter Index (NPS) score for customer and employee experience.

Insurance companies can achieve excellence in operations management with Business Process Management (BPM), because it makes it easier for each organization to work in alignment with its objectives, while designing, managing and improving the activities necessary to create products and services. and provide them to your customers. And respond to the new business models that are created in its digital transformation. With BPM, insurance companies achieve:

- EFFICIENCY: obtaining the maximum of available resources (maximum productivity) achieving the objective.

- EFFECTIVENESS: achieve the objectives that customers expect from a process in accordance with the values stipulated by the organization.

- PRODUCTIVITY: Processes achieve desired goals, and are predictable because they achieve predefined results over and over again with maximum productivity.

.

RELACIONADO

-

Why BPM is vital for companies in the energy and utility industry

by Albatian July 13, 2020

-

Before automating a process ... improve it!

by 4 Jan. 8, 2020

-

How to guide organizations in Maturity in BPM?

by 4 March 16, 2019

-

How to select a BPM software?

by 4 Dec. 17, 2018

-

Process Mining plays an essential role in Digital Transformation

by 4 Sept. 6, 2018