¡HI! If you want to propose us a project, send a mail to info@albatian.com

ALL INFORMATION ABOUT

BPM, PROCESS, R & D, TECHNOLOGY

How to Calculate the ROI of a BPM Initiative?

By: Pedro Robledo, BPM process management expert

As the implementation of BPM (Business Process Management) in your organization is not only the implementation of BPM technology, to analyze the profitability to be obtained it is necessary to take into account the entire BPM Life Cycle. You must evaluate both the investment to be made and the benefits in each phase. It is also necessary to take into account in the analysis the number of BPM projects that will be implemented during the time period of study so that all costs in the project to be studied will not be reimbursed, but will be divided proportionally.

A priori it is possible to know the amount of the investment of a BPM initiative in the organization, but what is more difficult is to estimate the benefits that we can obtain of that investment. That is, as reflected in the investment made in the organization, understanding that they will generate positive changes in it, qualitative and quantitative. In many cases, the very need to solve a problem in the organization already guarantees the investment, but even so it will be convenient to analyze the return.

In order to start the analysis correctly, it will be useful to have current metrics of the previous situation of the organization before starting the BPM initiative, so that they provide us the benefit to achieve according to the objectives.

The profitability is analyzed by the calculation of ROI (Return On Investment), which is a method that allows us to evaluate the value that gives us the realization of a certain project or investment in Business Process Management. This analysis compares the return on investment over costs by building a ratio or percentage to give us an idea of how much is recovered for each euro that is invested. If we consider the rate of return to be 6 months, a figure of 100% means that the investment returns in 6 months, 200% in three months and so on. An investment rate of less than 0% means that resources have been lost in the project.

Two ROI calculations are recommended for a complete analysis, the expected ROI (calculation of the initial ROI when the BPM initiative is in the project phase) and the Actual ROI (ROI calculation during the implementation and deployment of BPM in the organization). This last ROI will be useful for future projects, to know if the current projects are productive for the organization and what have been the advantages and problems of the deployment and deployment.

Based on my experience as a consultant supporting and advising companies in the calculation of ROI, the organizations ask mainly four questions of profitability: how much will they pay for the costs in the implantation and the deployment ?, how to transform the non-economic benefits in economic values for the analysis ?, how to control the risks that can be generated during the implantation so that the analysis is useful? And how to perform the analysis?

I suggest the following methodology for analyzing the return on investment in a BPM initiative by calculating the ROI:

1. VALUE TCO (Total Cost of Ownership) BUDGET

Initially, it will calculate or allocate an investment budget for the BPM initiative in the organization, which may be a percentage of the profits recorded during the Previous Year. For example, if the benefits were B €, and a maximum BPM implementation of 10% of the benefits is estimated, we would have a budget of (B * 0.10). Budget that we call TCO's Budget Value, considering TCO (Total Cost of Ownership) as an indicator that measures the efficiency or value of the investments necessary to carry out the BPM project, which will allow us to analyze all the costs involved as a consequence of the introduction of BPM, in relation to the budget. With this maximum value we will see if we achieve profitability or require more investment.

2. QUANTIFY COSTS BPM PROJECTS

In the same way that when a person buys a vehicle is not only fixed in the price of the same, but also in the consumption of gasoline, insurance, repairs and maintenance ... when implementing BPM technology, we do not analyze only the licensing cost of the BPM solution, or the cost of developing the first project, but we must analyze all associated costs such as support, training, maintenance and upgrade costs. Negative flows, ie project expenditure in the form of direct visible costs (such as software license, hardware price, support cost, installation cost and cost of specialized staff) must therefore be analyzed, And hidden costs (usually not budgeted initially) that are linked to the application of technology (insurance, depreciation of goods and software, replacement of equipment for obsolescence, legal costs, patents, contracts, legal provisions, personnel costs, costs of scalability Of the project, regular services, inputs ...), which impact on the organization's income statement.

3. QUANTIFICATION OF BENEFITS

To arrive at a specific ROI figure, it is necessary to estimate, as economic figures, the benefits obtained (qualitative and quantitative) in the implementation of BPM. That is, translating the improvements to euros, and this is the complicated part of the ROI calculation, but it is the one that brings the most value to the customer. To provide a complete understanding of the return on BPM investment, positive flows will be calculated by taking financial and non-financial indicators (such as: customer satisfaction, process times, process volume, goal or outcome compliance, error rates during the process, reduction of risks, response times ...).

Five axes can be identified to investigate potential benefits where to focus to establish indicators to be used for calculations: automation, optimization, quality, solution development and compliance with regulatory frameworks.

For the calculation of the positive flows we can calculate the income generated by the project in the form of reductions in process times and costs and increase of market share thanks to the release of resources, that is, revenues will be produced in the form of increments of productivity, which will be measured by taking a base unit that allows us to convert the benefit into an economic data. For example, if we reduce labor costs by process automation, we will take the cost of process-related personnel as the base unit: if, for example, a saving of 5 workers is achieved in the process with an average salary of 1000 € by month, it generates a positive impact of 5 x 1000 x 12 = 60,000 € by year.

In the case of direct cost savings (such as paper savings): if you generate approximately 1500 paper invoices by month and now with BPM are not printed, the savings would be: considering that one 500-sheet package is worth approximately € 2, then each sheet costs us € 0.004. If each invoice is printed on a single sheet, the invoice saves at € 0.004. The shipping of the invoice by Postal costs the envelope (0.95 € unit), the printing target 0.10 € and the stamp 0.50 €. Therefore: 1500 invoices x (0.004 sheet + 0.95 envelope + 0.10 label + 0.50 stamp) = 1500 x1,554 = € 2,333 savings by month x12 months = € 27,972 saved by year.

More positive impacts on the business: Gross margin increase (eg. elimination of intermediaries); Cost savings due to time reduction; Cost saving in the automation of manual processes; Cost saving by automatic integration with applications; Saving the costs of obtaining information; Saving of costs in time in decision making; Increase of benefits by Quality; Increased benefits for improved availability; Decrease in losses due to fraud; Benefits for improvement of processes; Benefits for attracting customers; Benefits for selling customized products ...

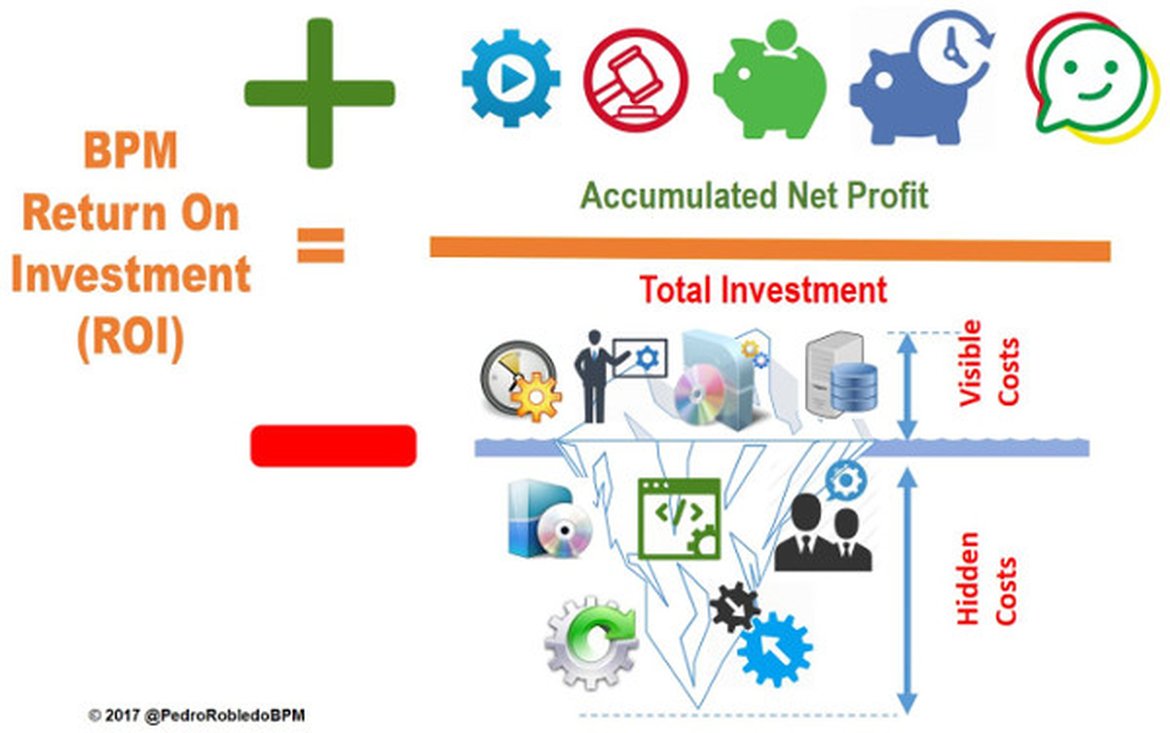

4. APPLY ROI FORMULA

The ROI formula shows the ratio of the net profit of a proposed project, divided by total costs. Expressed as a formula, it can be represented as ROI = (accumulated net profit) / (total investment). The Accumulated Net Profit will be equal to the subtraction of the negative flows of the positive flows, and the total investment is expressed as the negative flows calculated in the TCO. The resulting ROI can be expressed as a percentage or as an economic return value versus each inverted economic unit.

The vast majority of BPM implementations do not allow a completely reliable estimate of the profitability that the organization will obtain because of the implementation of BPM, but using best practices and the explained methodology an estimation can be made to assist the managers in the making of concrete decisions in this topic.

RELACIONADO

-

Not enough with an independent Management of a Process

by 4 May 9, 2017

-

Industry 4.0: the bpm challenge

by 4 July 9, 2017

-

Any Business Innovation and Transformation requieres an Enterprise Architecture

by Albatian March 27, 2017

-

Process Digitalization in Digital Transformation

by Albatian Jan. 9, 2017

-

Digital Transformation Life Cycle

by Albatian Nov. 14, 2016

-

How to select a BPM software?

by 4 Dec. 17, 2018

-

BPM is key to the Digital Transformation

by Albatian Oct. 4, 2016

-

BPM is the most effective discipline of business management

by Albatian Sept. 15, 2016

-

How to guide organizations in Maturity in BPM?

by 4 March 16, 2019

-

The company connected

by Albatian April 19, 2013

-

¿BPMS for moments of crisis?

by Albatian Nov. 12, 2012